Healthcare Benefits Updates

Changes to Retirement Healthcare Premium Payments Coming Jan. 1, 2025

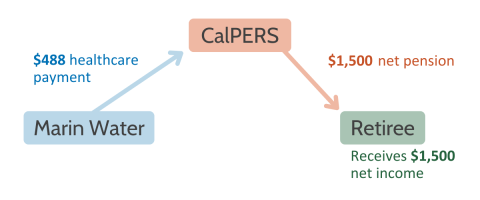

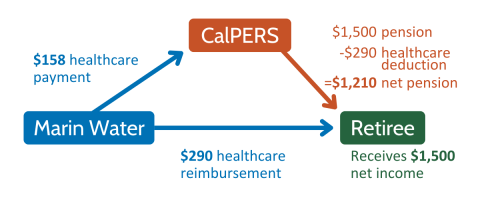

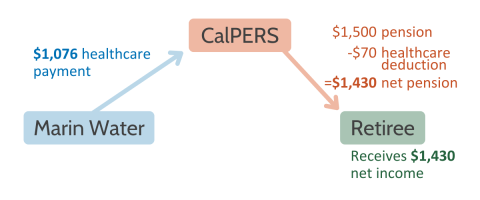

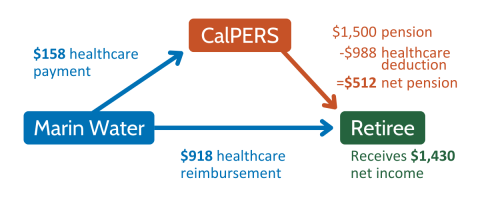

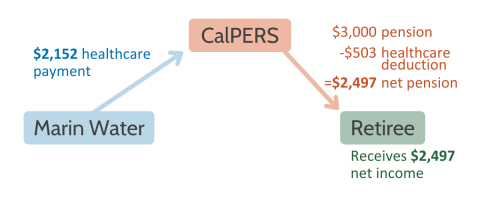

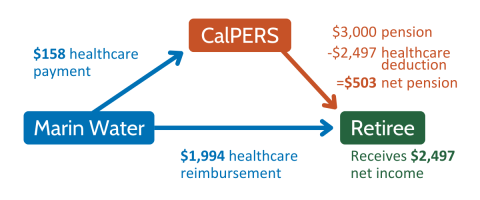

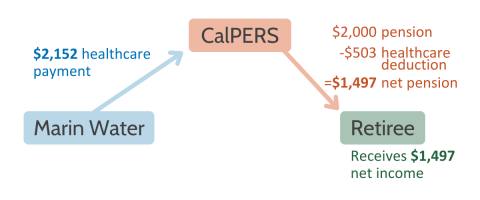

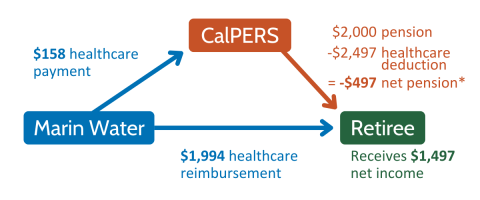

Beginning January 1, 2025, Marin Water is implementing changes to the way that retiree healthcare premiums are paid each month. This will NOT change the amount of your benefit.

The full amount of the District’s contribution toward retirees’ monthly healthcare premiums will no longer be paid directly by the District to CalPERS. Instead, CalPERS will deduct a portion of the premium amount from a retiree’s monthly CalPERS pension and the District will provide a direct reimbursement to the retiree for that amount.

How will retirees receive the payment for reimbursement of their premiums?

To implement this change, Marin Water has entered into a health reimbursement arrangement (HRA) that will be administered by a third-party vendor – the P&A Group.

Under this arrangement, P&A Group will be responsible for administering the monthly reimbursement payments described above through a separate payment at the beginning of each month. The first HRA healthcare reimbursement payment will sent to retirees by mailed check in early January.

After retirees receive their first reimbursement check, they will have the opportunity to enroll in direct deposit, if they choose. With direct deposit, the reimbursement will be automatically deposited into the retiree’s designated checking or savings account within 1-2 business days at the start of each month.

If a retiree chooses not to enroll in direct deposit they will continue to receive the monthly reimbursement by check; check processing takes approximately 3-5 business days to process. The checks will be mailed via U.S. postal mail after processing. To avoid processing and postal mail delays, Marin Water highly recommends that retirees enroll in automatic payment.

Download the Health Reimbursement Plan Summary

How can retirees enroll to receive premium reimbursement payments by direct deposit?

Retirees will receive instructions for creating an account and enrolling in direct deposit with P&A Group by early January 2025 and may enroll in this payment option any time thereafter.

Why is the District implementing this new process?

The District negotiated a new labor contract with its employee union in 2023. The new contract establishes a graduated vesting schedule to determine the District's contribution to retiree healthcare benefits for employees hired after January 1, 2024. With this change, CalPERS is no longer able to administer retiree health care reimbursements from the District. To ensure that reimbursements are properly administered, the District is partnering with the P&A Group to distribute healthcare reimbursement payments on a monthly basis.

When will I receive the reimbursement check?

The first check will be mailed before January 1, 2025. Retirees will have the option to enroll in direct deposit with the P&A Group after the first check is received. After direct deposit is set up, reimbursements are scheduled to be deposited on or before the 1st of each month.

What is the tax impact of this change? Will the P&A reimbursement be taxed?

The District does not anticipate any tax implications caused by this reimbursement payment. The reimbursements from P&A Group are not subject to income tax and the P&A Group will not be sending an end of year tax statement. Individuals with questions regarding tax implications should contact their income tax professional.

Who can retirees contact if they have any questions?

Please contact Marin Water Human Resources staff by phone at 415.945.1434 or by email at HumanResources@MarinWater.org.

Example Scenarios

Translate

Translate